You're here because ChurnZero's pricing, setup timeline, or operational complexity doesn't match what your team can absorb right now. Maybe the $40,000 annual price tag feels steep, or the six-to-eight-week implementation window is too long when customers are slipping away today.

Perhaps you're wondering if there's a smarter path than committing to a platform that needs dedicated CS Ops resources your startup doesn't have yet.

This guide tackles the real question: which customer success solution fits your actual team size, budget, and growth stage, not the team you hope to build someday.

You'll see how five distinct alternatives compare to ChurnZero, from enterprise platforms down to lightweight analytics layers, complete with the pricing details and implementation timelines that most comparison articles conveniently skip. More importantly, you'll get a practical framework for narrowing your shortlist based on company stage rather than wasting three months trapped in discovery calls with five different sales teams.

Whether you're evaluating renewal options, implementing CS tooling for the first time, or trying to stabilize customer health while working within a tight startup budget, here's how to find your right fit.

Understanding ChurnZero and when to look elsewhere

ChurnZero occupies an interesting middle ground in the customer success platform market. It sits between Gainsight's enterprise-grade complexity and truly lightweight alternatives, delivering comprehensive health scoring, automated playbooks, and in-app messaging capabilities at around $15,000-$26,000 annually after the typical 60% discount most customers negotiate.

What ChurnZero delivers:

- Unified health scores pulling data from CRM, support, billing, and product usage.

- Automation engine handling complex multi-step customer journeys and renewal forecasting.

- Native integrations with Salesforce, HubSpot, Zendesk, and 20+ other platforms.

- In-app messaging and product walkthroughs without separate tools.

For teams ready to centralize CS operations in one platform, ChurnZero delivers genuine power, but that power comes with tradeoffs that don't work for everyone.

Why companies explore alternatives

The most common reasons companies switch from ChurnZero center on cost, complexity, and timing mismatches.

Primary friction points:

- Cost: List prices range from $20,000 to $87,000 annually depending on team size and account volume – numbers that simply don't pencil out for early-stage SaaS companies still validating their customer success motion.

- Implementation timeline: Six to eight weeks minimum before your team sees meaningful value, assuming you have someone available to configure health scores, build playbooks, and coordinate the rollout.

- Operational requirements: Need for dedicated CS Ops resources that smaller teams don't have.

Many companies exploring alternatives realize they need faster setup without dedicating full-time CS Ops resources, or they discover their team already lives in Slack and wants customer health signals delivered there rather than in yet another platform they need to check daily.

The admin gap at early-stage companies

ChurnZero needs an owner. Someone has to configure those health scores, build and maintain playbooks, manage data mappings between systems, troubleshoot integration issues, and optimize rules as your product and customer base evolve.

The catch-22 for early-stage teams:

For many SaaS companies, CS Operations roles only become financially viable around the $10 million revenue mark when you can justify dedicated headcount for platform management. Below that threshold, the administrative burden falls on whoever's available – usually a CS leader or founder who should be talking to customers instead of debugging Salesforce field mappings.

This creates a painful reality: early-stage teams desperately need visibility into customer health, but the platforms built to provide that visibility require operational resources they simply don't have yet. The result is either underutilized tools that never deliver ROI, or leadership spending 10-15 hours weekly on platform admin when they should be preventing churn.

When ChurnZero is still the right choice

ChurnZero makes complete sense for specific company profiles, and recognizing when you fit that profile saves everyone time.

Ideal ChurnZero customers:

- Mid-market to enterprise SaaS with 5+ customer success managers needing centralized workflow management.

- Salesforce-first organizations getting strong value from native integration and bidirectional data sync.

- Teams requiring in-app messaging and product walkthroughs without separate tools like Pendo or Appcues.

- Companies ready to invest in CS Ops resources – either a dedicated hire or significant time allocation from leadership.

The key qualifier is simple: you're ready to invest in CS Ops resources to maintain and optimize the platform, because the platform's power requires ongoing attention to deliver its full value.

Five ChurnZero alternatives compared

The customer success platform landscape breaks into distinct tiers serving different company stages. Gainsight delivers enterprise-grade operations, Planhat and Vitally occupy the modern mid-market space, Custify targets SMB teams, and Accoil takes a fundamentally different approach as an analytics layer.

CS managers consistently praise Vitally's modern UI, appreciate Planhat's customer-count pricing that doesn't penalize growing teams, and acknowledge that ChurnZero's power requires dedicated admin resources many smaller companies lack.

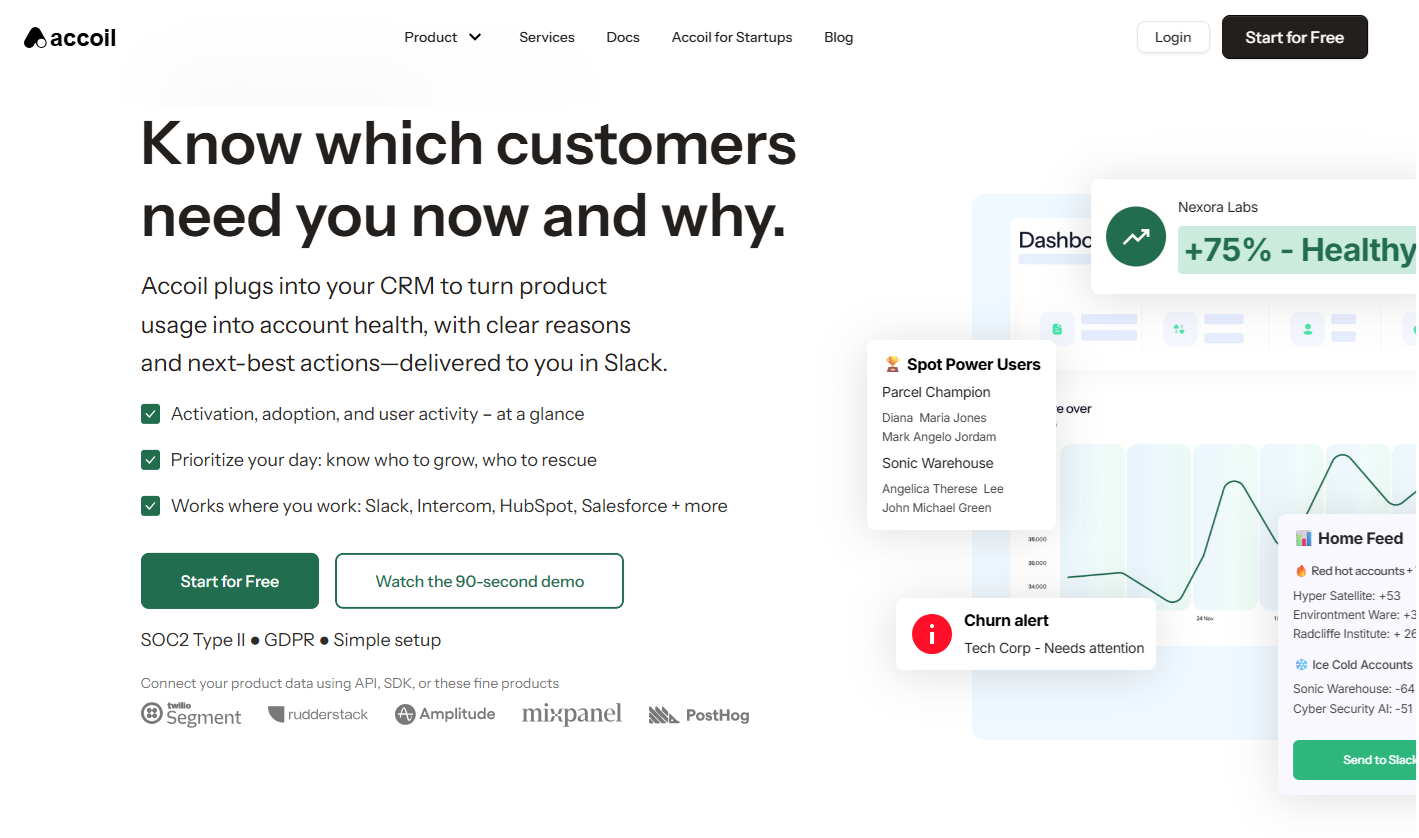

1. Accoil for analytics-first teams

What it is: A B2B SaaS customer analytics layer built on account-level product engagement, delivering health signals into Slack, HubSpot, and Salesforce where GTM teams already work.

Pricing: Starting from $50/month and scaling into the low thousands based on active accounts. Unlimited seats at all tiers, and our pricing calculator lets teams see exact costs instantly.

Implementation: Under 24 hours when connecting to existing CDPs like Segment or Amplitude.

Best for: Seed to Series A teams under 50 employees needing visibility without platform overhead.

What you get:

- Account-level health scores with clear explanations.

- Proactive alerts when accounts slip or show expansion signals.

- Next-best actions surfaced in your CRM.

What you don't get:

- Journey orchestration or automated workflows.

- In-app messaging capabilities.

- Task management or team coordination.

Choose when: You want health signals in Slack and CRM in under 24 hours, not a full CS platform to administer.

2. Gainsight for enterprise operations

What it is: Enterprise standard with ML-powered scoring and forecasting for large CS organizations.

Pricing: $60,000-$100,000+ annually, often exceeding $200,000 for complex deployments.

Implementation: 3-6 months for full platform.

Best for: Organizations with 15+ CSMs needing centralized coordination.

Key requirements:

- Dedicated administrator (often $100,000+ specialists).

- Budget for both licensing and operational resources.

- Need for advanced reporting to demonstrate CS ROI.

Choose when: You have enterprise scale, budget for specialized resources, and can absorb the complexity.

3. Planhat for high-touch teams

What it is: Modern alternative to Gainsight with superior UI and customer portal capabilities.

Pricing: $25,000-$40,000+ annually based on customer count, not user seats.

Implementation: 2-4 months with dedicated project management.

Best for: High-touch CS models with many CSMs managing fewer high-value accounts.

Standout features:

- Built-in customer portals for sharing success plans and dashboards.

- Strong integration library including data warehouses.

- Unlimited seats with customer-count pricing model.

Choose when: You need customer-facing portals, the unlimited-seat model fits your structure, and you want modern enterprise functionality without Gainsight's complexity.

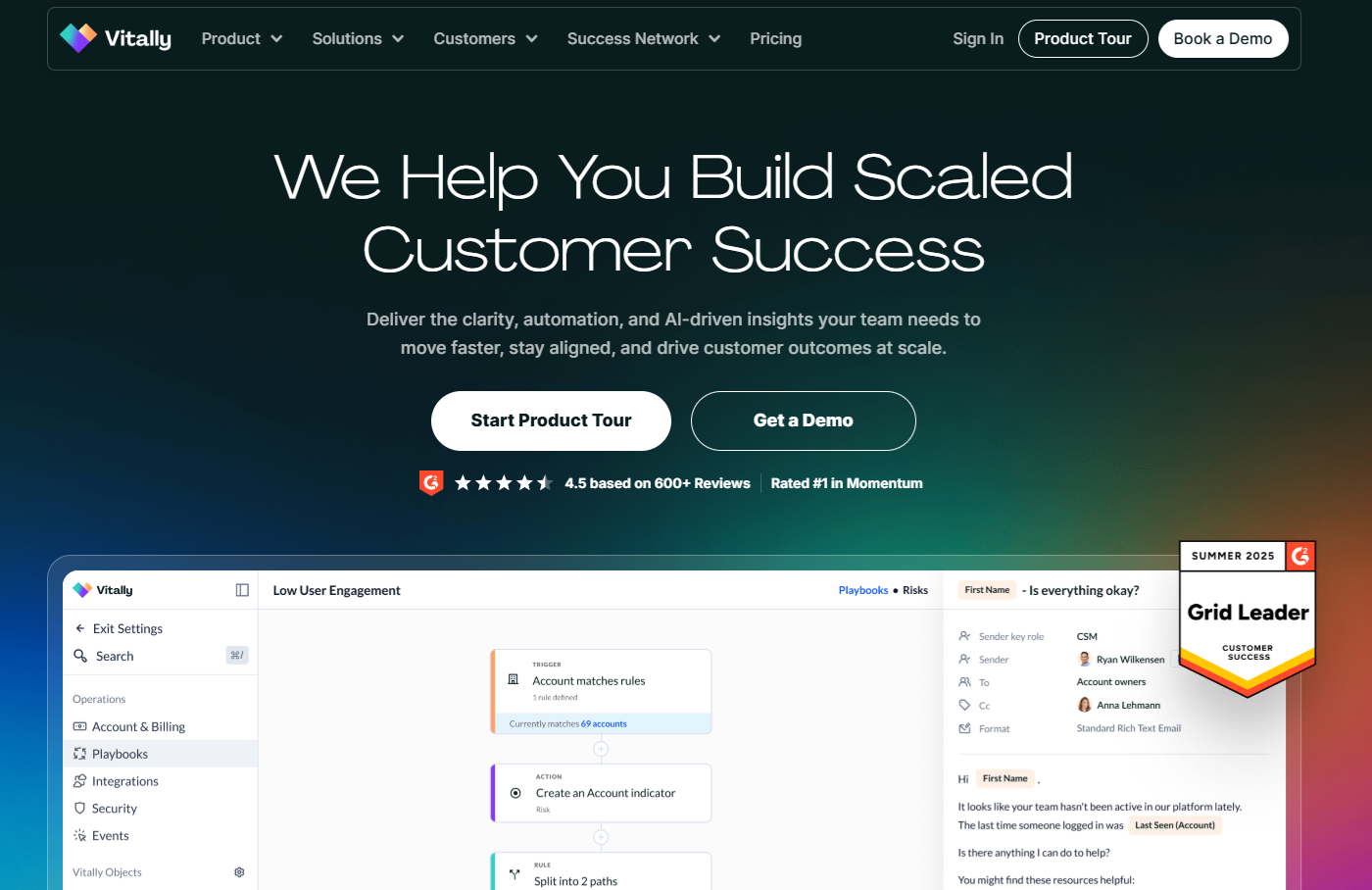

4. Vitally for mid-market efficiency

What it is: Modern platform bridging lightweight tools and enterprise solutions.

Pricing: $1,000-$3,000 monthly depending on scale and features.

Implementation: 2-4 weeks, significantly faster than enterprise platforms.

Best for: Teams growing from 5-15 CSMs who need power without overwhelming complexity.

Key advantages:

- Clean interface with fast adoption curves.

- Real-time health tracking and automation.

- Team collaboration features built in.

Choose when: You're scaling CS operations, need a platform that won't overwhelm your team, and want implementation in weeks not months.

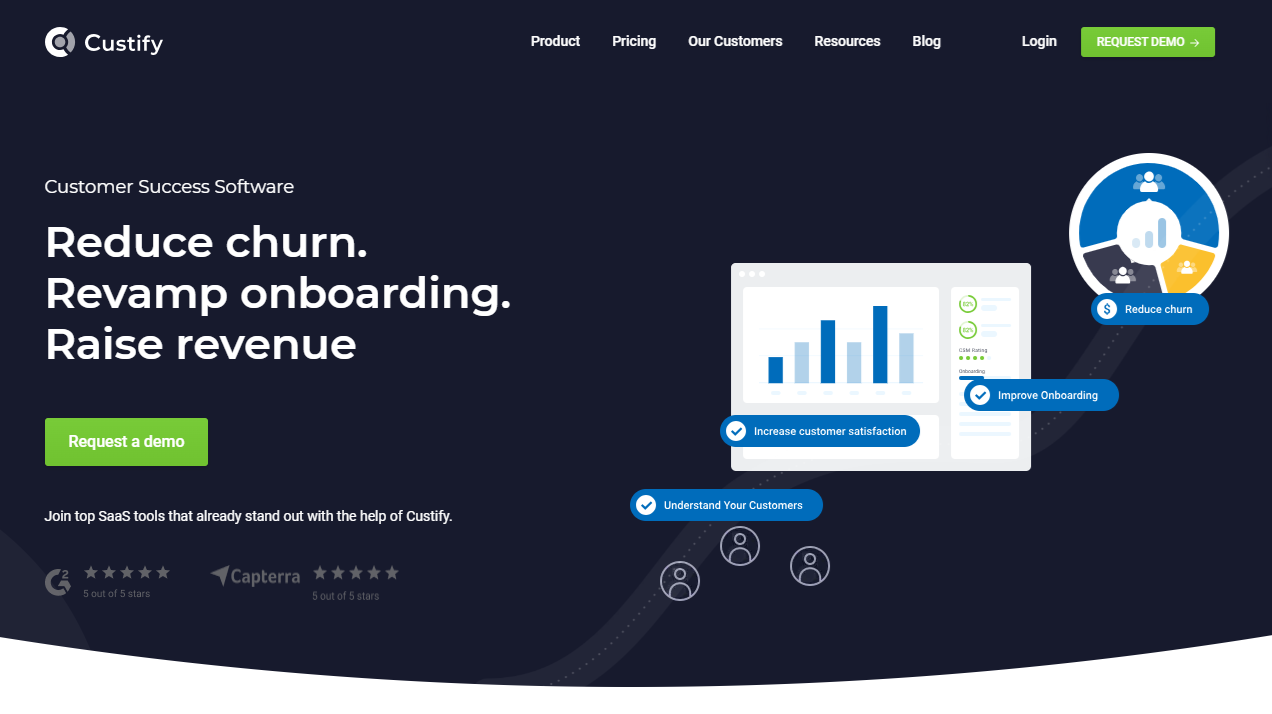

5. Custify for small team automation

What it is: Accessible CS platform for SMB SaaS teams with white-glove onboarding.

Pricing: Approximately $500-$2,000 monthly depending on scale.

Implementation: 2-4 weeks with guided setup.

Best for: Teams under $10M revenue needing structured processes without enterprise complexity.

Core capabilities:

- Task management and success planning.

- Workflow automation for common CS processes.

- Complete CS functionality without heavy configuration.

Limitation: Lacks depth of integrations and analytics that larger organizations require.

Choose when: You need workflow automation and structured planning, have a small team, and want a complete platform without dedicated CS Ops resources.

Choosing the right fit for your team

How many features the platform has isn't what matters. What matters is how fast it helps you get value, how much complexity your team can handle, and whether you need a full system or just clear visibility into account health. Some teams want full-service platforms to manage every customer interaction. Others just need a tool that flags risk early and keeps things simple. Be honest about where you are today, and where you're heading in the next 18–24 months. That's what keeps you from buying something that looks good in theory but ends up collecting dust because no one has time to set it up.

Feature comparison: customer success platforms vs analytics layers

Platforms like ChurnZero, Gainsight, Planhat, Vitally, and Custify are built to run workflows. They orchestrate customer journeys, manage CS team tasks, and serve as the operational hub for customer success. Accoil is an analytics layer that plugs into your existing stack, so it deliberately skips heavy automation features in favor of delivering health signals where teams already work.

| Feature | ChurnZero | Gainsight | Planhat | Vitally | Custify | Accoil |

|---|---|---|---|---|---|---|

| Health Scoring | Yes | Yes | Yes | Yes | Yes | Yes |

| Journey Automation | Yes | Yes | Yes | Yes | Yes | No |

| In-App Messaging | Yes | Yes | No | No | No | No |

| Task Management | Yes | Yes | Yes | Yes | Yes | No |

| Customer Portals | No | No | Yes | No | No | No |

| Slack-First Interface | No | No | No | No | No | Yes |

| Works inside existing GTM tools | No | No | No | No | No | Yes |

| Time to first health signal | 6-8 wks | 3-6 mos | 2-4 mos | 2-4 wks | 2-4 wks | Under 24 hrs |

| Under $5k/yr for early-stage teams? | No | No | No | No | No | Yes |

The pattern reveals itself clearly: big platforms like ChurnZero, Gainsight, and Planhat offer a full range of features – automated customer journeys, task management, and centralized CS operations. But setup takes months, and you'll need ongoing team resources to run them.

Mid-market tools like Vitally and Custify hit a middle ground. You get a solid feature set and can be up and running in weeks, but you trade off some of the depth that enterprise tools offer.

Then there are analytics-first tools like Accoil. These don't try to manage your workflows – they focus purely on visibility and alerts. You get health signals within 24 hours, but you'll still need to manage engagement using the tools you already have.

It's a clear trade-off: platforms give you more automation and control but need more time and people. Analytics layers give you fast insights but leave the actioning up to you.

Tools for specific jobs and integration depth

Beyond full CS platforms and analytics layers, specialized tools excel at narrow jobs that might be critical to your retention strategy. These focused solutions often outperform general-purpose platforms in their specific domains.

Specialized retention tools:

-

Pendo: In-app guidance and product analytics. Combines user behavior tracking with walkthroughs. Drives feature adoption without engineering involvement. Particularly valuable for educating users on complex products.

-

GUIDEcx: Multi-party onboarding coordination. Manages tasks across your team, customers, and third-party vendors. Provides project structure that general CS platforms don't match.

-

Churnkey and Raaft: Cancellation flow optimization. Focus exclusively on the final retention moment. Present targeted deflection offers and gather exit feedback. Can save 15-30% of cancellations that would otherwise complete.

Integration depth determines success:

Integration depth often matters more than feature lists – a platform that doesn't connect cleanly to your existing stack becomes another data silo requiring manual work to maintain.

Extensive integration libraries (Planhat, Vitally):

- Connect to data warehouses like Snowflake and BigQuery.

- Include support systems, billing platforms, and marketing automation.

- Provide comprehensive customer context without manual data exports.

CDP-focused approach (Accoil):

- Connects via Segment, Amplitude, and PostHog.

- Integrates with core GTM tools: Slack, HubSpot, Salesforce, Intercom.

- Leverages data pipelines you've already built rather than requiring custom API work.

Before committing, verify integration quality:

Native integrations sync data bidirectionally in near real-time, while Zapier workarounds introduce 15-minute delays and troubleshooting headaches when fields don't map correctly. A platform with fewer native connections to your specific stack will create more ongoing operational burden than one with deep integrations, even if the feature list looks less impressive on paper.

Why Accoil works differently for early-stage teams

Accoil solves a problem most CS platforms ignore: how do you get customer health visibility when you don't have the budget, timeline, or operational capacity for traditional platforms? The answer is to stop trying to replace your entire CS stack and instead deliver insights where your team already works. Accoil isn't a CS platform or a BI tool – it's a product analytics intelligence layer designed specifically for revenue teams.

What Accoil provides:

- Account health scoring with clear explanations using a small set of opinionated metrics rather than asking teams to design health models from scratch.

- Proactive Slack alerts when accounts slip.

- CRM field enrichment surfacing insights in HubSpot or Salesforce.

Accoil integrates with Slack, HubSpot, Salesforce, and Intercom rather than replacing these tools, which means zero workflow disruption and no adoption curve for teams to climb.

The trade-off is explicit: you don't get journey orchestration, in-app messaging, task management, or team workflow automation. You also can't collect NPS surveys directly, though Accoil can ingest NPS data if you're already gathering it elsewhere. For early-stage teams, this focused approach delivers 80% of the value in 5% of the time and cost.

How Accoil solves the admin gap

The operational reality that kills CS platform adoption at early-stage companies is simple: ChurnZero and similar platforms need CS Ops resources that don't exist until around $10 million in revenue, while Accoil requires no dedicated administrator.

Speed advantage:

- Enterprise platforms: Months to configure health scores, map data fields, and build playbooks.

- Accoil: Signals in under 24 hours by connecting to your existing CDP.

This zero-ETL (Extract–Transform–Load) approach leverages product usage data you're already collecting through Segment, PostHog or Amplitude – meaning you avoid the extra engineering work of pulling data out of one system, reshaping it, and loading it into another rather than requiring custom API work or new instrumentation. Your engineering team stays focused on product development instead of building yet another integration.

Economics that actually work for startups:

Accoil starts at $20 monthly for qualified early-stage startups, with unlimited team seats, and scales based on monthly active accounts. At higher volumes, pricing can reach into the low thousands monthly, with per-account costs dropping to $0.14 or less as you scale, compared to $20,000+ annual contracts with per-user pricing that penalizes CS team growth.

A five-person CS team paying $40,000 annually for ChurnZero could run Accoil for an entire year at under $3,600, leaving $36,400 for hiring another CSM or funding product improvements that actually reduce churn.

Who benefits from the analytics layer approach

The ideal Accoil customer has a specific profile: Seed to Series A teams under 50 employees who need customer health visibility immediately but lack the budget for enterprise platforms that cost more than their entire CS team's salaries combined.

Perfect fit indicators:

- Live in Slack for daily collaboration.

- Already use HubSpot or Salesforce for customer data.

- Want health signals delivered where work actually happens.

- Have product analytics implemented (Segment, Amplitude, PostHog).

- Can't dedicate 10-15 hours weekly to platform configuration.

The approach particularly fits organizations that prioritize visibility over automation. If your leadership team is still handling customer success directly, or if you have one or two CSMs wearing multiple hats, you need to know which accounts need attention today, then handle outreach through the communication tools you already use effectively.

Not a fit if:

- You're B2C or pre-PMF and still significantly changing your product.

- You're shopping for a BI tool, data warehouse, or full CS platform with workflows, tasks, and in-app messaging built in.

- You don't yet track product events.

When platforms beat analytics layers

Honesty about limitations prevents frustration later: analytics layers aren't suitable for every team, and some needs genuinely require comprehensive platforms.

Choose platforms when you need:

- Multi-step customer journeys with automated email sequences triggered by behavior.

- In-app messaging and product walkthroughs driving feature adoption.

- Task assignment and workload balancing for 10+ CSMs.

- Operational coordination showing what each CSM is working on.

The decision framework is straightforward: choose analytics layers like Accoil when health visibility matters more than workflow orchestration, and choose platforms when you're ready to centralize CS operations with the time and resources required to maintain them.

Most teams eventually need platforms as they scale, but starting with immediate visibility often beats waiting months for comprehensive solutions you're not ready to operate effectively.

Start tracking customer health today

You've seen where ChurnZero shines with comprehensive automation, which tools fit different company stages, and how analytics layers deliver immediate visibility without platform overhead. The pattern holds across every option: full CS platforms trade speed for power, requiring weeks or months before delivering value, while lightweight tools trade depth for simplicity, getting you productive immediately with gaps you'll fill using existing tools.

For early-stage teams caught in the admin gap – needing customer health visibility now but lacking budget and operational capacity for traditional platforms – Accoil solves a different problem. It delivers the visibility you need to stop surprise churn without the platform overhead you can't absorb, working inside Slack and your CRM rather than requiring another tool to check daily.

If you're ready to see which accounts need attention today rather than waiting months for comprehensive solutions, start Accoil's free trial and get health scores flowing in under 24 hours.