You know the story: an account that "looked fine" right up until it churned, or a power user who quietly vanished weeks ago while the dashboard stayed reassuringly green. These surprises happen because account-level metrics smooth over the details that actually matter.

If you're tired of renewal surprises derailing your quarter, it's time to fix it with a signal-based approach.

As the market shifts from growth at any cost to efficient revenue, Net Revenue Retention (the revenue you keep and expand from existing customers) matters more than chasing new logos, especially when capital is tight. Retaining and expanding existing revenue is what matters, yet most CS teams still don't spot renewal risk until the clock's almost run out.

We'll cover why risk stays hidden until renewal time, how to build a segmented renewal playbook, which product-usage signals will allow you to foresee outcomes, and how early-stage teams can make renewals predictable – without six-figure tools or a dedicated CS Ops function.

Why customers leave without warning

Customer success renewals happen when existing customers decide to continue their subscription at contract end. That's recurring revenue earned by delivering value consistently – which is why the real work starts much earlier than 90 days out.

The problem is most teams don't realise an account is wobbling until the cancellation email hits the inbox.

Your account-level metrics hide power user departures

You've likely seen this play out: A customer you believed was happy gives two weeks' notice. The last QBR went well. The relationship felt solid. What actually happened is less reassuring – your account-level metrics looked fine while your power users quietly stopped showing up.

This is one of the most common renewal mistakes CSMs make. You lean on relationship instinct instead of usage data, miss power user drop-off, and step in too late when discounting is the only lever left. Your dashboard stays green because five occasional users logged in this week, while your key user hasn't touched the product in three weeks. If you catch it early, you can recover value without discounting.

Account-level health scores blur individual behavior. When you track total logins or rolled-up usage, a few active users create the appearance of health while the people who influence renewal decisions disengage. What you need is clarity on which users actually matter and whether they're still active.

Stop churn before it starts

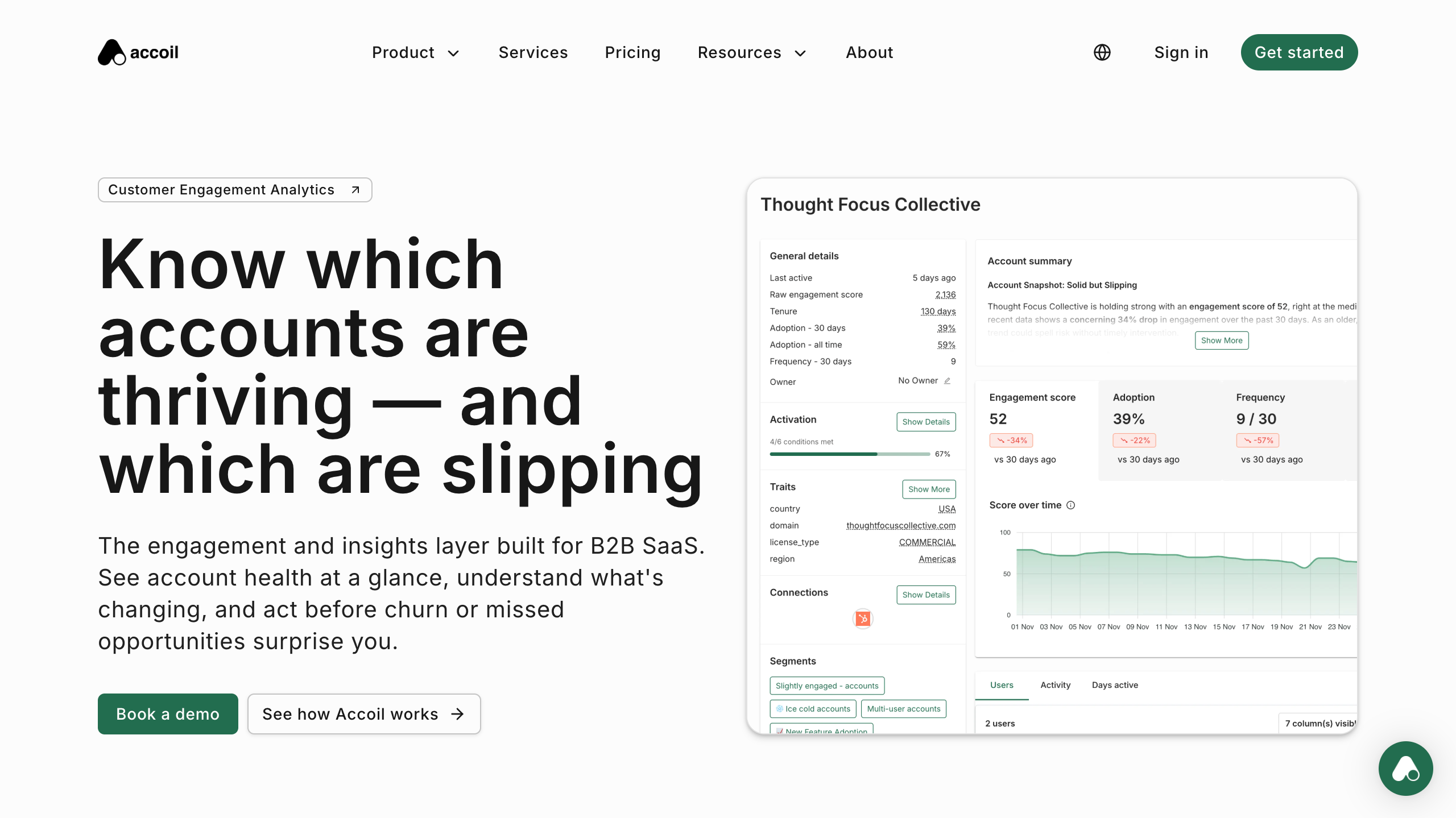

No more dashboards and guesswork. Accoil translates usage signals into simple, account-level health scores your team can actually act on.

See how Accoil flags churn risk

Why surveys and sentiment scores miss early risk

That glowing QBR feedback from six months ago doesn't predict renewal outcomes. NPS surveys and quarterly reviews surface issues after customers have already looked elsewhere. Once a Detractor score appears, the decision to leave might have already been made.

Renewals protect your existing contract value by keeping the subscription in place. Expansion grows revenue through added seats, higher pricing tiers, or increased consumption (credits, API calls, compute units) after renewal is secured. Each relies on different signals, but renewals require earlier action because you're defending revenue already at risk.

Although sentiment data is nice, it reflects how customers felt about past experiences, not whether they're getting value today. A customer might rate you highly in February and stop using core features by April. The survey captured a moment. Usage shows the direction, and that's what predicts renewal.

Why your team can't translate data into daily priorities

Product analytics tools explain what happened, not which five accounts need attention today, or why. When you have customer data living across CRM, support tools, billing systems, and product events, stitching it together takes analyst-level skill most CS teams don't have or have time for.

Rather than another dashboard to remember, your team needs clear signals delivered where they already work. The problem is that enterprise CS platforms can take three to nine months to implement and only make sense once teams are large and workflows complex. Before that, they're expensive overkill.

Meanwhile, the data you need is already there; the missing link is being able to translate product behavior into clear and actionable insights.

How to make renewals predictable across the customer journey

Treating renewals as a once-a-quarter exercise is a recipe for being blindsided by churn. Strong renewal outcomes are built from day one through steady value delivery, not in the final 90 days before the contract is up. Here's how to structure your renewal work across the full customer lifecycle.

Start renewal work at signup, not 90 days out

Onboarding is key – you need your customers to reach first value milestones and adopt the core features that make your product stick.

That early window sets the tone for everything that follows. If users don't form habits, see progress, or connect usage to real outcomes early on, no amount of late-stage check-ins will save the renewal. That's why the smartest teams treat onboarding as the first renewal play: guiding customers toward meaningful actions, watching for early signals of traction (or friction), and intervening while there's still time to change the story. From there, you need to adopt proactive measures, including:

- Flagging power users who go inactive for 21+ days.

- Intervening with discovery initiatives or offers before customers start comparing alternatives.

- And yes, tracking usage trends 90 days pre-renewal.

Usage, rather than vibes, is the priority. What customers do in the last 90 days is a stronger predictor of renewal than relationship history from earlier touchpoints. A great onboarding six months ago won't save a renewal if usage has quietly slid all quarter.

Stop guessing which usage actually matters

Accoil surfaces the few signals that reliably predict renewal risk – so your team knows where to act, and when.

Explore Accoil's signal-based approach

Match your renewal timeline to contract size

Not every renewal needs the red-carpet treatment, which is why scaling your efforts with contract value can be a sensible choice.

With SMB customers on smaller deals who usually need a 30–90 day window, you can keep things light: quick check-ins, simple usage reviews, and clear next steps. They care about speed and clarity, not drawn-out business reviews.

Mid-market customers typically justify 90–120 days. This is where structured business reviews earn their keep by showing outcomes achieved, ROI, adoption trends, and how you're fitting into their bigger picture.

With enterprise customers with contracts over $50,000 you're looking at 180+ days. Expect multiple stakeholders, detailed ROI documentation, and executive alignment, plus procurement processes, budget cycles, and approval chains that move at their own pace.

A strong renewal playbook covers the whole runway:

- A T-180 health check to surface risk early.

- A T-90 value review grounded in usage data.

- T-60 pricing conversations to address objections.

- And T-30 contract delivery to leave room for approvals.

Renewal ownership evolves as you scale

The answer to whether customer success should own renewals changes as the company grows. At seed stage, sales usually handles renewals. By Series A, customer success often takes over as the function matures. It's only when you hit scale that dedicated renewals teams emerge, with the volume making specialization worthwhile.

Each model has trade-offs. CSMs bring deep customer context but must balance relationship-building with quota pressure. On the other hand, dedicated renewals teams scale more efficiently and build negotiation expertise, but they lose some day-to-day customer insight.

A dedicated Renewal Manager role typically makes sense once annual contract volume reaches around 200+ renewals, or when the CS team is large enough that a standardized process is needed to stop accounts slipping through the cracks.

Tight alignment between CS and sales is critical. Conflicting outreach on pricing or terms is a fast way to sink a renewal. Few things confuse (or annoy) customers more.

Lead with usage data, not relationship history

How should a CSM handle renewal conversations without sounding like a salesperson? Start with usage data that shows outcomes achieved, and frame renewal as a continuation of proven value, not a fresh pitch.

Business reviews at T-90 should highlight active user percentage – how many licensed seats are actually in use – alongside feature adoption depth and relevant roadmap items tied to customer goals. These inputs shift the conversation from "can you renew?" to "here's what you're getting."

Auto-renewal works well for low-touch, product-led customers who prefer self-service. Conversation-based renewals are better suited to high-touch accounts that need clear value articulation and strategic alignment.

Just be sure to prioritize usage evidence. When you can show that 85% of a customer's team actively uses the product and adoption has grown 40% year over year, claims of "not seeing value" tend to fall flat.

Build a signal-based system that predicts renewals

Waiting for customers to say they're unhappy is already too late. Strong customer success teams rely on systems that surface renewal risk and expansion potential automatically, using product behavior signals. Done right, this creates a predictable, data-driven renewal motion instead of last-minute surprises.

The four signal types that predict renewals

Reliable renewal forecasting depends on tracking four clear signal categories.

Product adoption metrics show whether customers continue to get value – active user percentage, depth of feature adoption, and changes in usage frequency all matter here.

Support quality signals flag friction early. Spikes in unresolved tickets, falling satisfaction scores, or negative sentiment in conversations are hard to ignore. When a customer suddenly starts opening multiple tickets, that pain will almost certainly resurface at renewal.

Financial signals offer early warnings before renewal talks even begin. Late payments, plan downgrades, or seat reductions are customers quietly reassessing value.

Relationship signals show up when engagement drops. Slower responses to outreach, no-shows on scheduled calls, or skipped QBRs suggest internal disruption, or outright disengagement.

Which signals drive immediate action

So, which KPIs actually matter for renewals? Prioritize:

- Active user percentage – the share of licensed seats truly in use.

- Power user login frequency.

- Core feature usage trends.

- Seat saturation.

- Week-over-week engagement score changes.

If your power user hasn't logged in for 21 days, that's a bigger red flag than any green account-level dashboard. Power users drive adoption, sell the product internally, and influence renewal outcomes. When they disappear, your champion goes with them.

Seat saturation above 80% paired with advanced feature usage points to expansion readiness, not just renewal safety. Customers are hitting the limits of their contract.

Pay close attention to declining use of sticky features that differentiate your product, rather than overall login volume. A customer may log in less but still depend on core workflows. When they stop using the features that create lock-in, they're actively looking elsewhere.

Why focused metrics beat unlimited customization

Seven well-chosen metrics provide clearer insight than dashboards packed with 50 configurable options that need constant tweaking. When everything is tracked, nothing stands out, whereas focus forces prioritization.

Pre-configured signal models allow you to skip the months it takes to build and maintain custom frameworks, instead delivering value in days. You don't need a full CS Ops function just to keep the lights on when the system is opinionated by design.

Event weighting makes this work. Logins score 1–2 because they're low-value signals – someone opened the app, but may not have done anything meaningful. Core workflow completions score 7–10 because they show real engagement. Publishing a report, completing a transaction, or inviting teammates signals deeper adoption than a simple login ever will.

90 days of behavior data predicts renewal outcomes

Ninety days of weighted behavior is enough to forecast renewals without waiting a full year. This window captures recent momentum while filtering out old patterns that no longer matter. What a customer did eight months ago won't decide next quarter's renewal.

Accounts move between forecast stages – commit, best case, at risk – based on score trends. Behavior-based forecasting replaces CSM intuition with engagement trajectories you can clearly explain to leadership.

The scores themselves stay simple. A 0–100 scale paired with plain-English explanations tells teams what changed and why.

"Account health dropped 15 points because your main power user went inactive for three weeks, and seat usage declined 20%" is actionable. "Account health is 67" is not.

Turn renewal risks into expansion opportunities

Customer Success Qualified Leads surface accounts likely to grow contract value based on usage patterns. Key expansion signals include 80%+ seat saturation, clicks on gated features, visits to upgrade pages, and support questions about higher tiers.

Prioritize accounts showing clear expansion intent instead of forcing growth conversations with customers who are merely stable and satisfied. Not every healthy account wants to expand, and pushing too early often creates friction.

When it comes to negotiation, preserve value with smart levers: term-length incentives such as 10% off multi-year deals, flexible payment options for cash-constrained buyers, or bridge contracts for at-risk accounts that need more time to realise value.

How Accoil makes renewals predictable for early-stage teams

A signal-based approach only works if the tools are practical. Here's how Accoil delivers clear renewal intelligence without the cost or complexity of enterprise software.

We built Accoil after churn blindsided us

Accoil was built by the team behind ThinkTilt (acquired by Atlassian in 2021), after we were blindsided by churn ourselves. The warning signs were there in product analytics, but uncovering them meant living in spreadsheets. By the time the story became clear, it was already too late.

Most tools told us what had happened, which worked for analysts, but not who needed attention today and why, which is what CS teams actually need. Product analytics platforms are powerful, but they assume CSMs have time to write complex queries. Enterprise CS platforms add workflow engines and heavy configuration that early-stage teams simply don't need yet.

So what helps manage renewals? Customer analytics platforms automate risk detection for early-stage teams. Full CS platforms add workflow management for larger organizations, at 10–50x the cost.

Works with your existing tools, no migration required

Accoil connects to the tools you already use, including Segment, RudderStack, Amplitude, and PostHog. There's no migration. You just plug into your existing product analytics pipeline.

Insights are pushed to where you already work – Slack, HubSpot, and Salesforce – instead of asking you to check another dashboard. Data starts flowing in under 24 hours, with actionable insights delivered in 2–3 weeks, rather than the 3–9 months typical of enterprise platforms.

You connect what you already have. Product data goes in. Renewal priorities come out.

Get health scores you can explain to your team

Accoil provides account- and user-level health scores (0–100), with plain-language explanations of what changed and why. Seven pre-configured metrics focus on common B2B SaaS patterns, avoiding endless customization that only analysts can interpret.

The 90-day window focuses on the period that actually predicts renewal risk, without drowning you in year-long histories, whilst Slack alerts add context you can act on:

"Power user at Account X inactive 21 days. Seat usage down 14%. Time to check in."

Right-sized for early-stage teams, not enterprise budgets

Pricing starts at $50/month, with no setup fees and no need for a dedicated admin. Enterprise CS platforms often cost $145,000–$330,000 in the first year, once you include implementation fees and admin salary, which is reasonable at scale, but hard to justify early on.

Accoil is built for CS managers who need clear answers, not analysts building custom dashboards. As you grow past 50–100 employees, you can add a full CS platform and keep Accoil's signal-based intelligence as your underlying data layer.

Make your renewals predictable starting today

You've seen how renewals are decided long before a contract's up, how a small set of behaviour signals beats sentiment surveys every time, and how a focused health model turns "this account seems fine" into clear, usage-backed forecasts.

A lack of data is not the real problem for most CS teams. It's turning product behavior into day-to-day priorities. You need sharp signals, delivered where your team already works.

Try Accoil to see how product usage becomes daily renewal priorities your team can act on, or book a quick walkthrough to see it live firsthand.

There's no need to get blindsided by churn. With Accoil, you can start acting on signals that actually predict renewal outcomes.