Most Seed to Series A teams know retention matters. When you save 10 accounts that were about to churn, you're not just rescuing this quarter; you're protecting the expansion deals and referrals those same accounts can generate over the next three years.

The problem is how to measure retention cleanly. MAU (Monthly Active User) dashboards can look healthy whilst renewals slip, or a power user, weeks before a contract ends, quietly fades out. And sure, retention isn't invisible, but the question is, how can you know which accounts need attention right now?

This guide gives you:

- Benchmark targets you can confidently stand behind.

- Tactics that move the numbers next quarter.

- And a framework for spotting churn risk weeks in advance.

You'll learn what good retention looks like at your stage, which metrics are actually worth tracking, and how to get account-level visibility without hiring analysts or rolling out heavyweight enterprise tools.

Whether you're justifying retention slides to investors or deciding which accounts to save first, this is your path from reactive firefighting to proactive retention.

What good SaaS retention looks like

So, you've landed product-market fit. Nice work. Now comes the part that actually makes SaaS businesses durable: keeping customers around. Retention costs far less than acquisition, and the gains stack up month after month. Whereas acquisition can get pricier, retention keeps paying dividends, which is why it's where your focus needs to shift.

So what does "healthy" retention look like in the real world?

B2B SaaS retention benchmarks vary by contract size and stage. Gross Revenue Retention (GRR) should sit at 90% or higher, with top performers exceeding 95%. Net Revenue Retention (NRR) scales with contract value: companies with $25K–$50K ACV typically see 102% median NRR, while those at $250K+ reach 110% or higher.

The core metrics worth tracking are:

- Customer Retention Rate (CRR): the percentage of customers who renew.

- Gross Revenue Retention (GRR): revenue retained before expansion, capped at 100%.

- Net Revenue Retention (NRR): retention plus expansion can exceed 100%.

- Customer Lifetime Value (LTV): total expected revenue from a customer.

The gap between GRR and NRR matters. GRR tells you whether you're holding on to what you've sold. NRR shows whether that base is growing through upsells and expansion. Both above 90% is a healthy signal, but an NRR over 100% means existing customers are actively funding growth.

Finally, you'll want to keep an eye on the Rule of 40. Your revenue growth rate plus profit margin should land at 40% or more if you want to show you can scale sustainably.

15 strategies that keep customers longer

1. Build customer communities for peer support

Customer communities lighten the support load and build emotional attachment that goes beyond the product. When customers answer each other's questions, swap creative use cases, and share best practices your docs never covered, they form relationships that make leaving feel costly.

Active communities correlate strongly with renewals. Whether it's forums, Slack groups, or dedicated platforms, customers gain a sense of belonging – they're not just users anymore.

2. Launch customer education programs

Training programs, certifications, and structured education raise product mastery and perceived value. Customers who complete certifications retain at higher rates because they've invested real expertise, creating a natural switching cost.

Focus webinars on advanced tactics rather than basic tours. Pair them with self-serve knowledge bases and video tutorials to cut tickets and boost activation. The goal here is depth.

3. Run beta programs with engaged customers

Invite power users to test features before release. Early access makes customers feel valued and gives them a competitive edge. Their feedback improves quality while deepening buy-in, and when features launch publicly, these users often become your loudest advocates.

4. Create customer advisory boards

Form a quarterly advisory group of 8–12 strategic customers to shape feedback and roadmap direction. Members feel invested, act as internal champions, and value the direct influence. Early access plus executive-level engagement builds stickiness well beyond feature sets.

5. Get customers to first value fast

Customers who reach their first value moment quickly stick around longer. Define what "first value" actually means, then design everything to get users there sooner.

- Track when users complete their first meaningful action and when teams adopt it together.

- Show setup progress so customers know how close they are.

- Introduce advanced features after activation, not all at once.

6. Build early warning systems with health scoring

Health scores flag at-risk accounts weeks before cancellation. Account-level scoring beats individual metrics, and transparent logic helps teams trust the signals. Weight recent behavior heavily – what happened yesterday matters more than last quarter.

7. Track feature adoption depth and breadth

Customers using 2–3 features churn easily. Customers using 6+ rely on you. Prioritize high-value features like integrations and collaboration over vanity metrics like logins.

This signal-led approach reflects how growth teams are moving from static forecasts to monitoring real-time behaviors that show momentum before revenue does.

8. Use cohort analysis to validate changes

Group customers by signup month to see what actually improves retention. Compare cohorts before and after changes to isolate the impact. Cohorts separate real gains from seasonal noise – without them, you're guessing.

9. Build systematic feedback loops

Survey your customers for feedback at completion moments while sentiment is fresh. You can use exit surveys at cancellation to uncover real reasons and friction points; just make sure you close the loop by showing how feedback shaped decisions.

Remember, behavior only shows what happened; surveys explain why. You need both.

10. Identify at-risk accounts early enough to intervene

Reduced logins and dropped features predict churn better than satisfaction scores, so you need to segment by likely cause – poor onboarding needs a different fix than missing features. By taking action early, you prevent small issues from becoming renewal killers.

11. Prevent involuntary churn from payment failures

Failed payments can cause churn that customers never intended. To limit it, email reminders 14 and 7 days before renewal can help to catch expiring cards. Let your payment processor handle dunning; use engagement data to spot risk early.

12. Spot expansion opportunities from usage signals

Customers hitting plan limits are raising their hand to upgrade, so look for starter plans with high active usage. By timing offers around peak engagement, you'll make your messages feel helpful rather than salesy.

13. Align cross-functional teams on retention metrics

Retention works best when it's a shared responsibility, as opposed to a side project. Put dashboards in front of everyone, and make retention matter just as much as new bookings by tying it into compensation. When sales teams are incentivised around renewals and NRR, and product teams can clearly see which features actually keep customers around, priorities tend to snap into focus. Round it out with monthly retention reviews to tackle the issues that fall between teams, and surface the data in the tools people already use.

14. Segment customers for targeted engagement

Not all customers need the same nudge, and treating them as though they do is a fast track to indifference. Segment your accounts based on behavior – high engagement, at-risk, unactivated, expansion-ready – and tailor outreach accordingly. A starter account slipping on usage needs a very different intervention from an enterprise customer eyeing expansion. So, be sure to keep segments updating automatically as behavior changes, and your campaigns will consistently outperform one-size-fits-all emails.

15. Align pricing with perceived value

Churn usually comes down to more than price alone – often, it happens when the value of your product feels out of sync. With per-seat pricing, declining usage is often the first warning sign, so tracking utilisation matters. Usage-based pricing can reduce friction by scaling more naturally with the value customers receive. Then, when it's time to raise prices, wait until value has clearly expanded, allowing you to monitor which tiers and terms perform best so you can keep refining your packaging.

Spot churn risk while there's still time

Accoil strips engagement back to the signals that actually predict retention, so your team knows who needs attention, why, and what to do next.

See how Accoil boosts retention →How Accoil delivers account health visibility

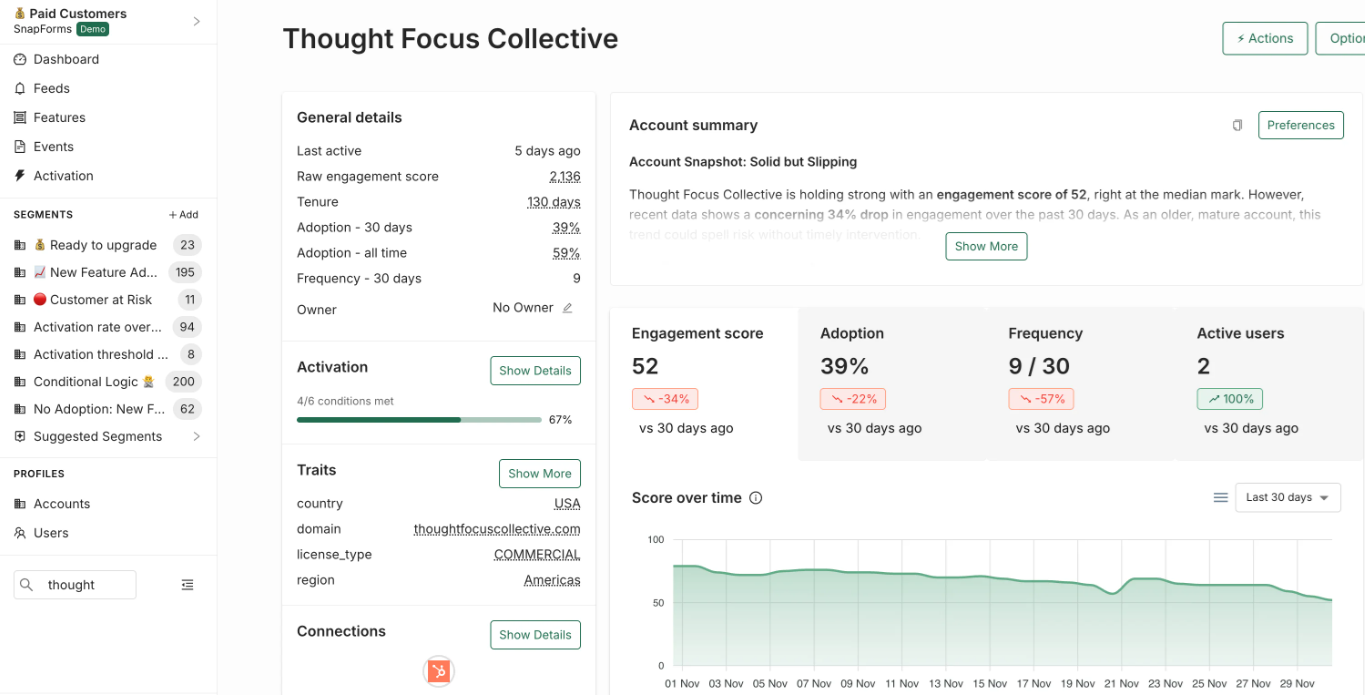

Most retention strategies live or die by visibility: account health, engagement trends, and early risk signals. Accoil plugs into your existing analytics – Segment, PostHog, Amplitude – via API and generates account scores in under 24 hours. No analysts required. Just clear, actionable signals that translate product usage into next steps for revenue teams.

Insights delivered where teams work

Accoil's Signals Feed keeps an eye on customer behavior and nudges you in Slack when something shifts:

"Acme Corp engagement dropped 40% this week; primary user inactive for 10 days."

That's something you can act on without babysitting yet another dashboard.

Behavioral segments update automatically as customers use your product, keeping targeting relevant without you having to manually manage lists. Engagement scores sync with Salesforce and HubSpot, so risk signals sit right alongside pipeline data. And with no SQL (Structured Query Language) and no analyst dependency, teams get fast answers to the only question that really matters: who's at risk, and why.

Built for early-stage through Series A B2B SaaS

Accoil is built for B2B SaaS teams from founding through Series A who need clarity without enterprise baggage. While Gainsight and ChurnZero demand long implementations and six-figure budgets, Accoil delivers account-level health scoring in days.

Pricing starts at $50/month, and scales based on Monthly Active Accounts rather than seats, so that adding your CSMs doesn't spike costs. With SOC 2 Type II and GDPR compliance included out of the box, and most teams see meaningful engagement insights within 48 hours, Accoil is a smart, low-friction way to get from raw product data to retention decisions you can actually act on.

Get visibility into your account health

Your product analytics already hold the clues to preventing churn. What you need is a way to turn those messy usage patterns into signals your team can use.

With Accoil, you get continuously updated account health scores, risk alerts sent straight to Slack when engagement shifts, and clear direction on which customers need attention today.

So, book a demo, and see how Accoil spots at-risk accounts within 48 hours.

FAQ

What are some common mistakes SaaS startups make that hurt their user retention?

Focusing only on user-level metrics instead of account health, waiting until renewal to review usage, and shipping features without validating their impact on retention.

How do typical SaaS retention rates compare to other industries, like e-commerce?

B2B SaaS generally sees higher retention than B2C subscriptions, driven by deliberate buying cycles, deeper workflow integration, and higher switching costs.