If you're here, chances are you've already wasted hours sifting through "best alternative" guides that never tell you the two things that matter most – how much these tools actually cost and how long they take to set up.

In this guide we'll skip the "Request a Quote" loop to offer you clear data, allowing you to match each option to your budget.

Here's what makes it different:

- We've gathered real-world pricing from actual implementations – not ballpark guesses.

- You'll get setup timelines that reflect your company size and data complexity.

- Tools are grouped by category, so you're not comparing lightweight products to full-blown enterprise platforms.

Treat this like your shortcut before jumping on sales calls. By the end, you'll have a clear view of which options fit your available funds, match your team's needs, and whether you even need something as complex as Gainsight in the first place.

So, no more discovery calls just to learn three of your options start at $50K a year.

First up, here's why more teams are starting to look past Gainsight.

Why teams look for Gainsight alternatives

Gainsight is a heavyweight in customer success software for a reason. It brings customer health tracking, success plans, and renewals into one place. If you've got 20+ CSMs following consistent processes, its automation features really shine. And its tight Salesforce integration is a big reason enterprise teams with CS ops staff rely on it.

But for smaller teams, the very things that make Gainsight powerful can start to work against you.

Common pain points with Gainsight

The first hurdle is the price. Gainsight doesn't list its pricing publicly, but most mid-market teams pay at least $30K a year. And that's just the starting point. You'll also need to consider:

- Long implementation timelines – around 5 months on average, according to user data.

- Heavy data engineering needs that delay results.

- The requirement for at least one ops person for every 5–10 CSMs to keep the system running.

For those in need of a leaner solution, more affordable options can be appealing. You've got Custify, Totango's Starter Plan, or Vitally – each built for mid-market teams that want power without the baggage.

Signs Gainsight is more than you need

You're probably overbuying if:

- Your team is under 10 CSMs with no ops person.

- You want usage-based health signals, not detailed success planning.

- You can't afford to wait three months just to start seeing insights.

- You already use modern tools like Segment or HubSpot to manage product data.

When enterprise platforms still make sense

Gainsight still has its place, especially if you're:

- Managing complex customer orgs with multiple products or deployment types.

- Relying on structured QBRs with detailed success plans.

- Driving revenue forecasting through predictive health scoring.

- Equipped with the budget and team to run a full-scale CS platform.

The bottom line is you need to choose a tool that fits your current needs, not what you imagine you'll grow into later. If you're a large, process-heavy CS org, the answer may genuinely be 'stick with Gainsight'; this guide is especially for earlier-stage teams who feel it's overkill.

Top six Gainsight alternatives

Now for what you came for – real alternatives with actual numbers. If you're a small business or startup, Totango, Custify, and Accoil are excellent picks. They give you clear customer health signals without the bloat.

The big names competing with Gainsight cater to different needs: Vitally suits fast-growing mid-market teams, ChurnZero is built for Salesforce-heavy orgs, Planhat handles complex setups, and Custify keeps it lean for smaller budgets. Here's how they compare on price, setup, and strengths.

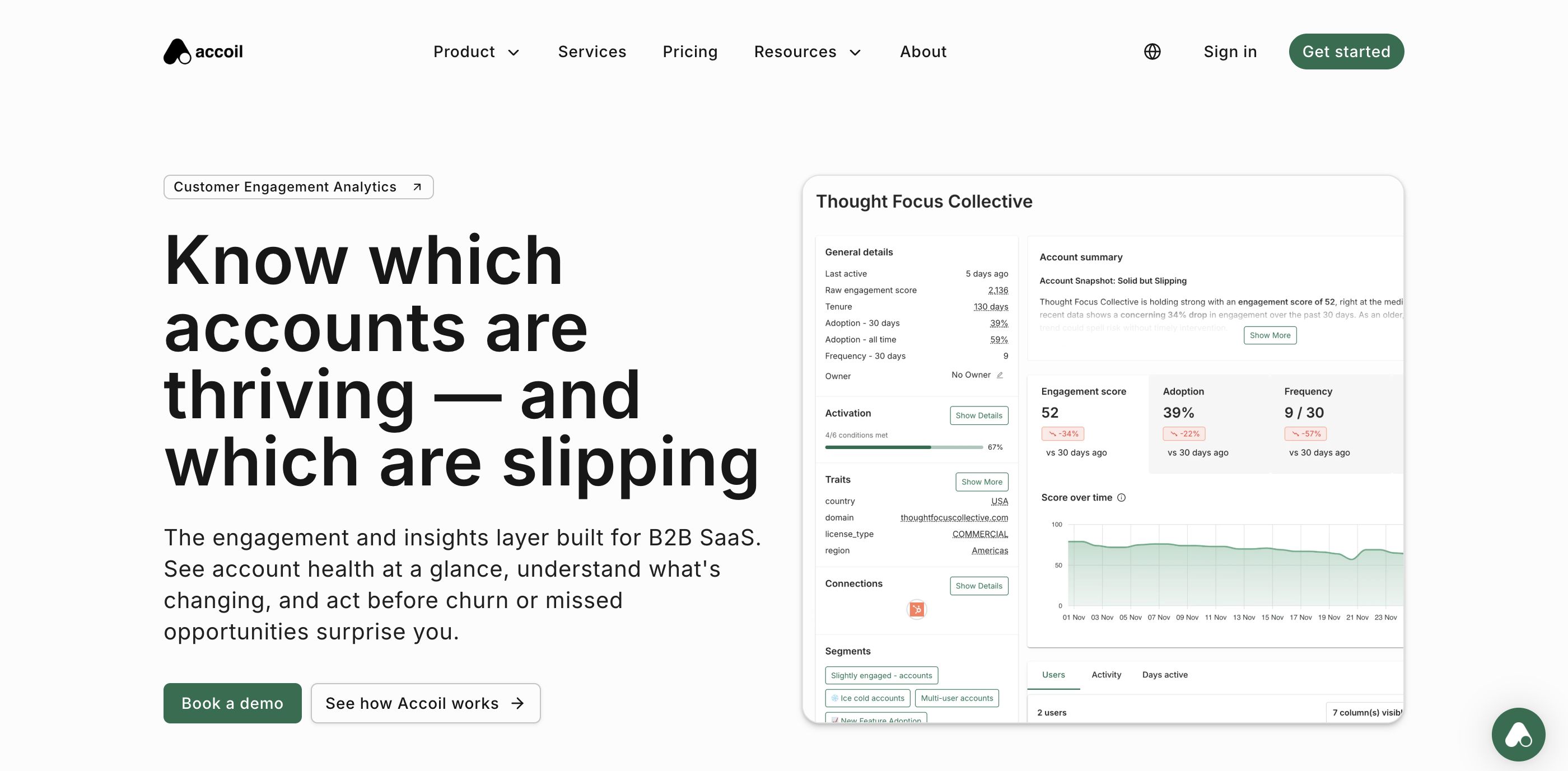

Accoil: Usage to health signals

You can think of Accoil as your CRM's nervous system. It turns raw usage data into customer health scores and sends that intel straight into Slack or your CRM, removing the need to dig through dashboards for solid insights.

- Price: Starts at $20/month for qualified teams with unlimited seats and a 90-day money-back guarantee.

- Setup time: 8–24 hours for data to start flowing; insights typically land within days.

- Best fit: Teams under 50 who want usage visibility without a heavy CS tool.

Take note: Accoil focuses on turning product usage into clear customer health and growth signals, rather than managing success plans or complex workflows. If your main problem is knowing which customers are at risk based on product behavior, Accoil ensures you'll have instant answers by next week instead of next quarter.

Vitally: For fast mid-market teams

Vitally balances power with ease of use. Pricing isn't public, but most users report it's well below enterprise-level costs.

- Price: Starting from $299/month for the basic plan.

- Setup time: 6–8 weeks – about three times faster than Gainsight.

- Best fit: Companies with 50–200 staff who are scaling CS seriously.

With automation tools and collaboration features that don't require technical skills, Vitally is a good fit for teams who've moved beyond spreadsheets but aren't ready for enterprise overhead.

Totango: Templates for faster setup

Totango uses pre-built SuccessBLOCs to speed up implementation, and its tiered pricing makes things accessible for most teams.

- Price: $249/month for 2 users.

- Setup time: Around 12 weeks, though templates can fast-track specific needs.

- Best fit: Mid-market companies with complex, data-driven CS needs.

The catch? Entry tiers limit how much data history you can access. But for onboarding and renewal flows, the out-of-the-box templates can considerably cut down your setup work.

ChurnZero: For Salesforce renewals teams

ChurnZero positions itself as the enterprise alternative that's actually implementable. Compared to Gainsight, ChurnZero offers similar enterprise-grade workflows but with faster setup (4-8 weeks vs. months) and particularly strong in-app messaging capabilities.

- Price: User reports typically cite $20K-$40K annually for mid-sized orgs.

- Setup time: 4-8 weeks for standard Salesforce integration.

- Best fit: Growing companies with dedicated CS teams managing high-volume, subscription-based customer portfolios.

Fair warning: you'll need ops support to get full value, and CRM support beyond Salesforce or HubSpot is limited. But for Salesforce-based teams focused on renewals, you get deep workflow integration, while HubSpot users get deal syncing and CSAT mapping that's built to perform.

Planhat: For complex data models

Planhat is made for teams that want to centralize all customer-facing workflows. It covers CS, RevOps, and services in one place.

- Pricing: Enterprise quotes only, with long sales cycles.

- Setup time: Several months due to complex data modeling.

- Best fit: Orgs needing a single system for cross-team visibility.

This is your choice when you need one platform to rule them all. If your team is serious about building a unified customer view, Planhat delivers – just expect a longer ramp-up.

Custify: For small teams on a budget

Custify is simple, affordable, and great for early-stage CS teams.

- Pricing: Starts at $899/month for up to 3 seats – one of the most accessible options for teams with fewer than 10 CSMs.

- Setup time: 6–8 weeks on average, with less complexity than enterprise alternatives.

- Best fit: Teams moving on from spreadsheets but not ready for a heavyweight tool.

Most teams outgrow Custify around 20+ CSMs when advanced features become necessary, but it offers a solid solution to get the essentials done well with minimal fuss.

When a full CS platform is more than you need

The truth is not every team looking for "Gainsight alternatives" actually needs a full customer success platform. Sometimes you just need better in-app guidance, or clearer visibility into product usage. Sometimes your CRM already covers most of what you need.

If your focus is on improving product experience rather than managing end-to-end customer success, look at tools like:

- Pendo – Offers product analytics plus in-app guides, surveys, and feedback tools.

- Appcues – Lets you build no-code onboarding flows and feature announcements without relying on developers.

- Userpilot – Built to drive user engagement and activation inside your product.

These are great for improving how users interact with your product – things like tooltips, walkthroughs, and onboarding flows. But they won't manage customer success operations or give you account-level health scores.

CRM-first setups in HubSpot and Salesforce

If you're already using HubSpot, you might wonder if Service Hub can take the place of Gainsight. The answer depends on how complex your setup is.

HubSpot Service Hub works well for:

- Teams with fewer than 10 CSMs needing ticketing and a knowledge base.

- Basic reporting and collecting customer feedback.

- Businesses that prefer to keep everything under one roof.

Where it falls short compared to dedicated CS platforms:

- Opinionated success plans and playbooks out of the box.

- Deep, product-usage-driven health models.

- Complex, multi-step CS workflows built specifically for CSMs.

Service Hub can support customer success teams, but it's still a generalist CRM and support tool – not a specialised CS platform like Gainsight or ChurnZero.

Salesforce users are in a similar boat. You can build customer success features using AppExchange tools or custom development – but at that point, you're spending time and money recreating what CS platforms already offer out of the box.

Usage-to-health layers for clear signals

This is where things get interesting for smaller teams. Usage-to-health tools layer on top of what you already use (Segment, PostHog, HubSpot, Salesforce) and focus on one job: turning product events into clear, actionable health signals.

Instead of setting up complex journeys and workflows, you get:

- Easy-to-read health scores your team can actually use.

- Alerts that show which accounts need attention today.

- Risk and upsell signals delivered in tools your team already works in (like Slack or your CRM).

- A setup process that takes days or weeks rather than months.

They're a great fit for CS and go-to-market teams who want to know who needs support or engagement right now, so CSMs know who to call today, sales can see which accounts are heating up, and leadership can spot risk or expansion earlier instead of reacting too late – all without getting bogged down in a heavy platform.

Accoil is a good example of this model. It won't replace ChurnZero's automation, but it will flag a trial user going quiet before they churn.

The best part is you get value fast – and can still scale up later if you need something more advanced.

Choosing the right alternative for your team

Before you dive into demos and pricing calls, let's make sure you're looking at the right category of tool. Plenty of teams waste time exploring platforms that don't solve the problem they actually need to fix.

Define the problem you're solving

The Gainsight alternatives market splits into four clear categories. Knowing which one you need will save time, money, and a lot of headaches:

- Full platforms for workflow orchestration (e.g., ChurnZero, Vitally, Totango).

- Product experience tools for in-app guidance (e.g., Pendo, Appcues, Userpilot).

- CRM-first solutions that build on your existing setup (e.g., HubSpot Service Hub, Salesforce + apps).

- Usage-to-health layers that surface GTM signals (e.g., Accoil, custom analytics tools).

Here's how to tell which fits your needs:

- Need to build automated workflows, success plans, and customer journeys? → Go for a full platform.

- Need health scores, risk alerts, and clear usage signals? → Choose an analytics layer.

- Need better in-app onboarding or feature adoption? → Pick a product experience tool.

- Want to get more out of your current CRM? → Look at CRM-first tools.

One thing to remember: customer success platforms go beyond your CRM. They add workflow automation, health scoring, and planning tools that CRMs alone don't cover. Salesforce might track opportunities and hold your records, but it won't flag users slipping away based on how they're using your product.

Match tools to team size and stack

Start with the basics: how big is your team and what tech are you already using?

- 1–5 CSMs, no ops staff – You'll want something you can get going with in days, not months. Tools like Accoil, Custify, or Totango's free tier are built for this.

- 10+ CSMs with structure – You can afford a longer setup window (8–12 weeks). Vitally, ChurnZero, and Planhat are strong fits.

- Already using HubSpot? Try Service Hub first – it may cover more than you think.

- Deep into Salesforce? Stick with platforms that integrate natively, like ChurnZero or any solid AppExchange partner.

A common pitfall we see is small teams buying heavyweight tools they never fully onboard, or fast-growing teams picking tools they'll outgrow too quickly.

Check pricing and total cost early

Don't fall for the trap of liking a platform before knowing what it really costs. Ask these questions up front:

- What's the total cost in year one; including base fees, per-user pricing, and onboarding?

- Is pricing based on users, accounts, or usage tiers?

- How long does setup usually take for companies like ours?

- Are contracts annual only, or is there a monthly option?

One thing to watch for: if a vendor won't give you a rough price without a discovery call, they're probably aiming at larger clients. The tools built for smaller teams – like Accoil, Custify, and Totango – are upfront about costs. If you're still scaling, a fully custom-priced enterprise tool may be more than you need.

Accoil: The nervous system for your CRM

While full CS platforms try to be everything to everyone, Accoil takes a radically different approach. It connects to your existing tools, monitors product usage in real-time, and flags account health issues as they emerge – which means you don't need to replace what you already use. And because CSMs, sales, growth, and leadership all see the same early warnings and opportunities, you get sharper alignment and faster action while avoiding the pain of a full rip-and-replace.

The team behind Accoil has done this before. They built and sold ProForma (ThinkTilt) to Atlassian, after 15 years working in B2B SaaS. They've seen what matters for retention and what doesn't. That shows in how the platform works:

- Built-in integrations with Slack, HubSpot, Salesforce, and Intercom, so you get alerts where your team already lives.

- Transparent health scores at both account and user level: zero guesswork, no black-box logic.

- Set up in a few hours, thanks to strong defaults that just work.

- Starts at $50/month with unlimited seats, so you can skip the need to get budget sign-off from the board.

When Accoil fits best

Accoil is built for smaller, fast-moving SaaS teams:

- B2B SaaS companies at Seed to Series A stage (under 50 employees) who need a clear view of usage, fast.

- Teams already using HubSpot, Intercom, or Salesforce, who want better data, not another platform.

- Customer success leads juggling multiple roles who need sharp signals rather than another dashboard.

- Companies already running tools like Segment or PostHog that want to make more of their product data.

It's not for you if you need structured QBRs, detailed journey mapping, or heavyweight workflow automation. Accoil is a signal system, not a full control panel.

Note: Accoil launched in 2024, but offers a 90-day money-back guarantee to reduce risk for early adopters.

How Accoil delivers signals

Accoil works by plugging into your existing tools and delivering clear, timely insights where your team already works:

- Data ingestion: It captures product events by connecting with Segment, RudderStack, PostHog, or Amplitude.

- Processing: It turns those raw events into account-level health scores using a transparent, weighted system.

- Delivery: It pushes those insights straight into tools like Slack (via daily feeds), HubSpot, Salesforce, and Intercom.

- Actionability: Daily risk and growth feeds flag exactly which accounts need your attention – today.

You don't need to log into another dashboard. You'll get a Slack update like: "Acme Corp's engagement dropped 40% this week – last active feature was Reports." That's how you move from data to action, supported by a service that stacks up well against the enterprise players.

Turn your research into a focused shortlist

You've looked through the main options. Now it's time to act.

You know when a Gainsight-style platform makes sense. You've seen how six alternatives compare – on pricing, setup time, and fit. You've also seen when it's better to go with a product experience tool, a CRM-based setup, or a usage-to-health overlay.

Here's what to do next:

- Got a large team and complex workflows? Book demos with Vitally or ChurnZero.

- Running lean and need something simple? Try Custify or Totango's free tier.

- Need in-app onboarding or walkthroughs? Look at Pendo or Appcues.

- Already deep in HubSpot or Salesforce? Check what your existing tools can do before adding more.

If you're a team of under 50 and need usage insights right away, Accoil is your best bet. You'll get account health data in Slack within 24 hours. You can forget heavy setup times and ops hires, with Accoil you simply get clear visibility into which customers need attention today.

Ready to stop the guesswork? Start your Accoil free trial and get your first health scores flowing by tomorrow.