That Pendo renewal email just dropped, and surprise, the price is up again; so if you're now suddenly Googling Pendo alternatives before signing on the dotted line, you're in good company. What often starts around $15,000/year can creep north of $35,000 once essentials like Salesforce sync or NPS surveys get locked behind higher tiers. Not cheap.

For B2B SaaS subscription teams, your options boil down to three practical paths:

- Deep analytics: Tools like Mixpanel or Amplitude for real-time funnels and cohort analysis.

- Balanced onboarding: Platforms like Userpilot that combine product analytics with straightforward in-app guidance.

- Speed on budget: Lightweight tools that get you live quickly, without the enterprise price tag.

In this guide we'll unpack all three. By the end, you'll know which Pendo alternative fits your product strategy, team skills, and renewal timeline; and you'll also see which tools you can trial safely without rocking your current setup.

Why teams start shopping when Pendo renewal approaches

Renewal season has a way of forcing honest conversations about what's actually working. When you find the price of renewal is double or triple what you paid on sign-up, you start asking tougher questions. Cost matters, but for SaaS subscription teams it's rarely the only trigger. By renewal time, early annoyances have piled up: analytics that refresh hourly when you need real-time insight, weak desktop tracking, and core features hidden behind tier upgrades that weren't clear during the sales process.

Renewal sticker shock hits harder than the first contract

Pendo's MAU-based pricing grows as you grow, which sounds fair until add-ons enter the picture. NPS surveys, session replay, and CRM integrations can push costs far beyond the original quote. Starter plans often jump from $15,000 to $35,000+ as soon as a team needs something as standard as Salesforce sync.

Custom pricing makes budgeting harder than it should be. With no published rates, you're pulled into sales calls before you can assess fit. For lean teams used to transparent pricing, easy trials, and decisions on their own timeline, that sales-led process adds friction.

Analytics arrive too late to protect the renewals you're trying to keep

Pendo delivers plenty of data: hourly updates, detailed event streams, custom dashboards. Yet the same question still comes up every Monday from CS: "Which accounts should I focus on this week?"

The platform doesn't answer that directly. You can see adoption metrics, login frequency, and cohort data – all accurate and useful. But spotting at-risk accounts means stitching together multiple reports, building custom views, and interpreting what a drop in usage really signals for renewal risk.

Dashboards get built for one question, then rebuilt as priorities change. This gets harder as teams scale and move from dozens to hundreds of accounts, where manual analysis no longer works. Pendo provides the inputs, but turning them into clear actions takes effort. At the end of the day most teams want analytics that surface problems and point to next steps, not just record what's already happened.

Implementation complexity outgrows what small teams can maintain

Getting value from Pendo takes time. Event taxonomy planning, dashboard setup, and guide configuration can take weeks before anything meaningful shows up. Desktop app tracking also has known limitations compared to web, which affects teams building hybrid products.

The Guides editor offers a narrow set of widgets, pushing teams to work around constraints rather than design the onboarding they actually want. Plus, the setup typically requires dedicated ownership – a CS Ops role or borrowed engineering time – resources even many Series A teams don't have.

ROI doesn't match the contract value

Vendr data puts the average Pendo contract at $47,330 per year, with deals ranging from $15,000 to $140,000. On Reddit, users report webhooks being priced as a ~$30k add-on rather than a "basic" feature for proper CRM integration.

As one customer who switched away put it: "High price was the decision criteria because we were paying lots and not using it." Key capabilities such as session replay, NPS, and Salesforce sync sit behind higher tiers or come as paid add-ons. With no published pricing and mandatory sales calls, it can be tricky for procurement teams to forecast annual SaaS spend with confidence.

Pendo alternatives organized by what you need most

The right Pendo replacement depends on what you're actually trying to fix. Some teams need deeper analytics with real-time updates. Others want simpler onboarding tools that don't require a data science degree to run. A few are looking for capabilities Pendo was never built for, like enterprise employee training or open-source flexibility. Below, the leading alternatives are grouped by primary use case, with the trade-offs spelled out.

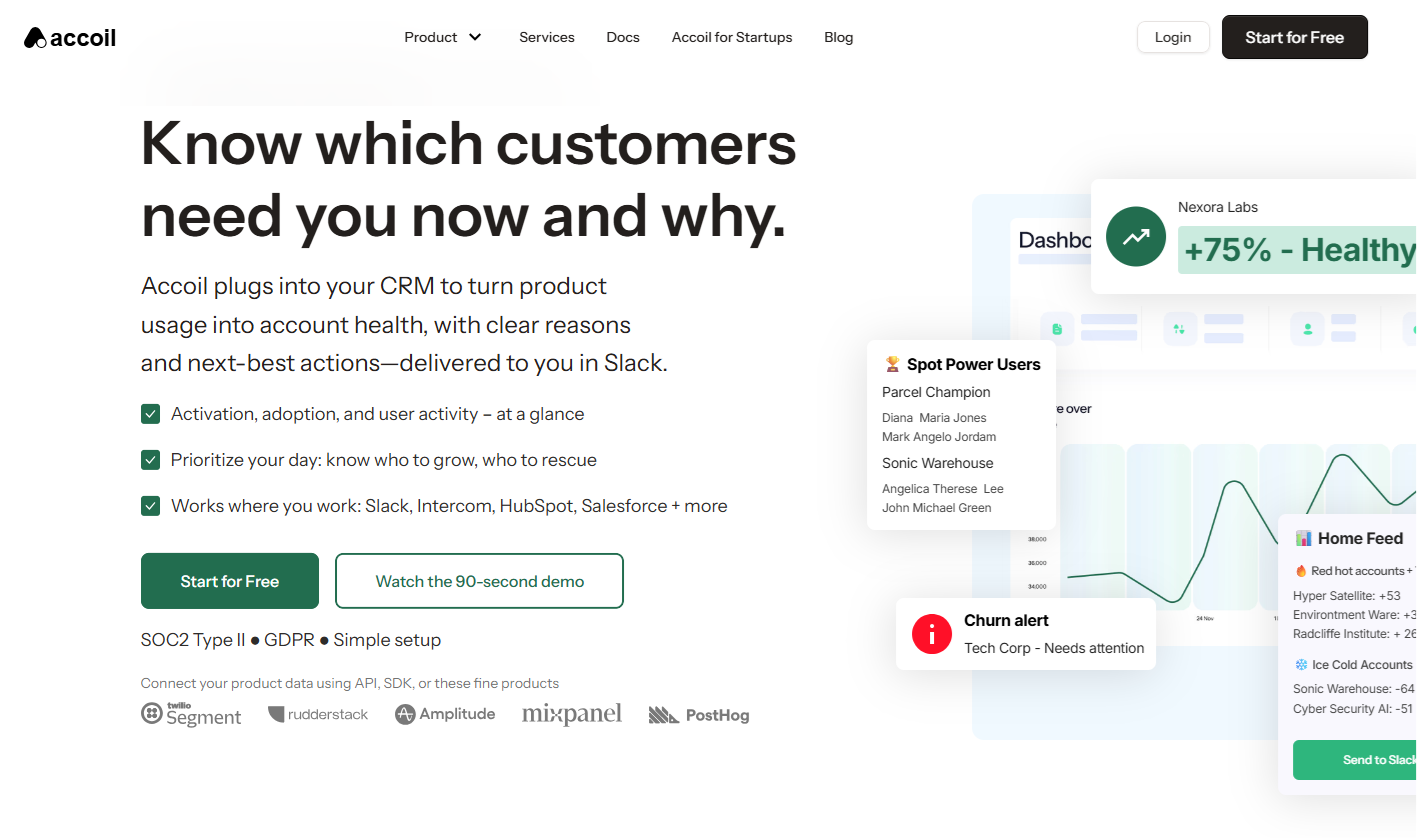

Accoil for account health signals without dashboard fatigue

Accoil turns product analytics into clear, account-level engagement scores that CS teams can use without learning SQL or building custom dashboards. It integrates with Segment, RudderStack, Amplitude, and PostHog, then calculates 0–100 health scores based on your own definitions of activation and retention.

Rather than logging into yet another analytics tool, teams get alerts pushed straight into Slack and CRM records, showing which accounts need attention and why. Accoil is built for B2B SaaS companies tracking accounts over time, not individual user behavior. Setup typically takes a few hours and connects through your existing data streams.

Stop churn before it starts

No more dashboards and guesswork. Accoil translates usage signals into simple, account-level health scores your team can actually act on.

See how Accoil flags churn risk

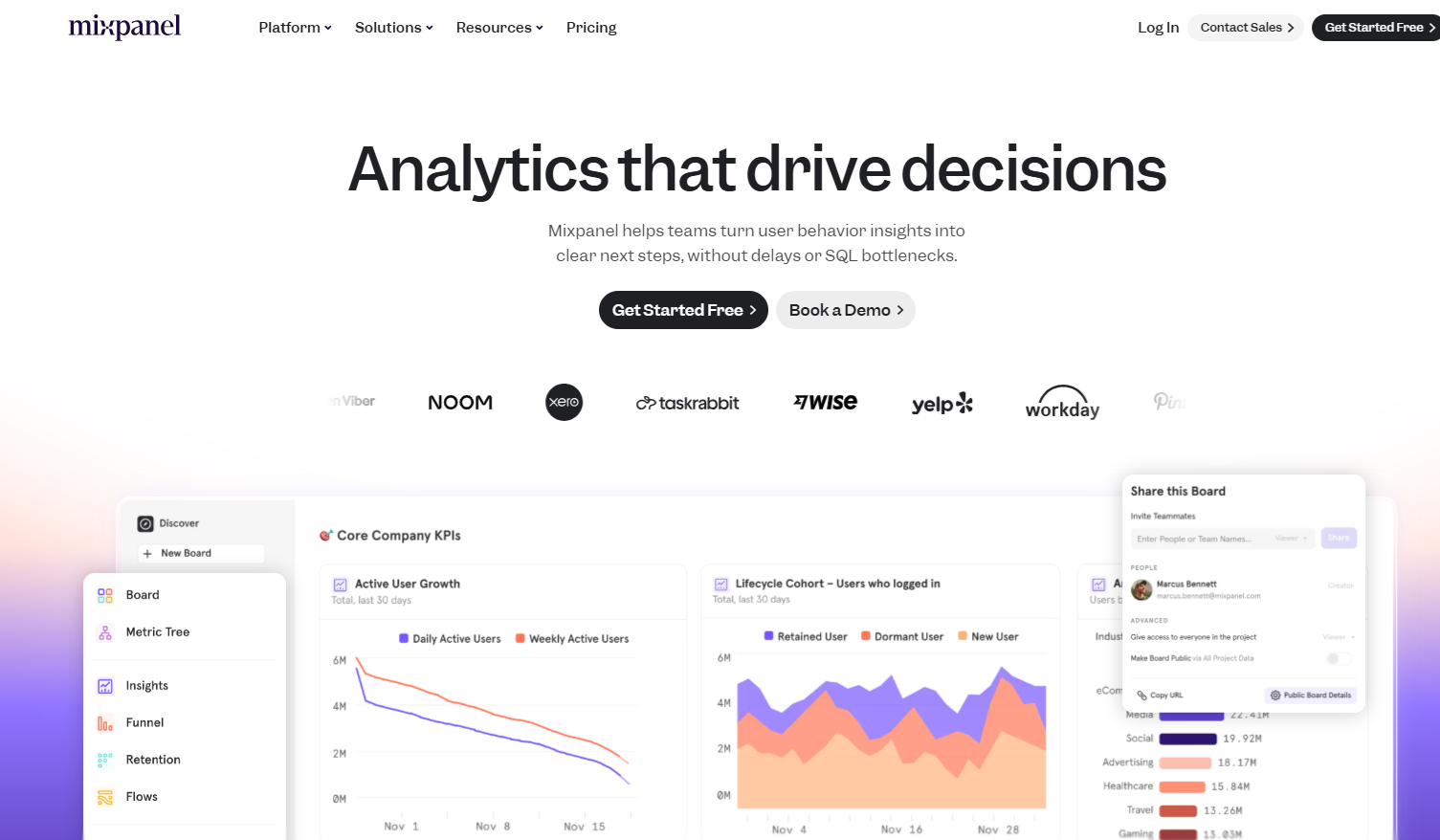

Mixpanel for flexible user journey analysis

Mixpanel offers unlimited funnel steps, detailed conversion tracking, and flexible cohort analysis for teams digging into user drop-off points. Reporting updates in real time as events stream in, avoiding Pendo's hourly batch processing that can leave teams waiting for current data.

The product was originally built for B2C apps tracking individual users, so account-level analysis requires Group Analytics add-ons or manual data aggregation. Implementation also takes engineering time to set up event tracking, plus analyst effort to build queries and pull out useful insights.

There is a free tier available for small teams, with paid plans starting from around $24/month, scaled by tracked users.

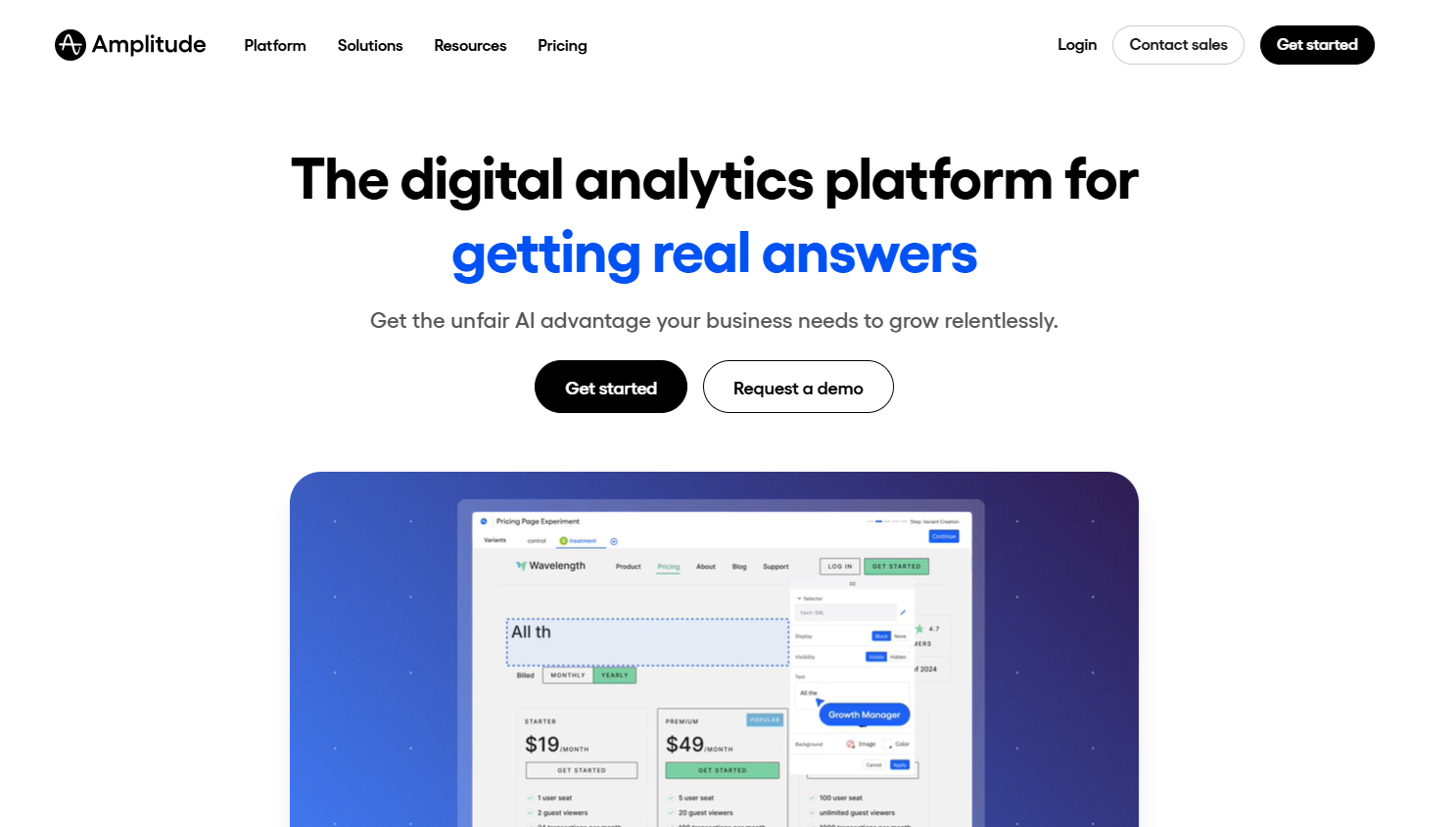

Amplitude for experimentation and testing frameworks at scale

Amplitude focuses on cohort analysis, A/B testing, and behavioral predictions for data-mature product teams. It's designed for PMs who want to evaluate feature performance using real analysis, not just presentation-ready charts.

Like Mixpanel, Amplitude was built for B2C use cases. Viewing engagement at the account level requires the Accounts add-on or custom data modeling to group users correctly. Implementation demands upfront event taxonomy planning and ongoing analyst support, since the tool won't interpret results for you.

The starter plan is free. Growth and enterprise tiers are priced by monthly tracked users with custom quotes.

Heap for capturing everything without planning ahead

Heap automatically captures every click, pageview, and form submission, with no need to decide in advance what to track. That means you can go back later and analyze behavior you didn't think to measure at the time, answering questions retroactively.

Fair warning: Heap really does capture everything. You'll either love having all that data or feel like you're drowning in unused events. Pricing requires contacting sales and typically starts around $3,600 per year for teams serious about autocapture.

Appcues for no-code product tours without developer dependencies

Appcues provides visual editors for tooltips, checklists, and tours, so product teams can make changes without filing engineering tickets. Its cross-platform support works across web and mobile, making it a good fit for B2B SaaS products used in multiple contexts.

It's often paired with Mixpanel or Amplitude, since Appcues focuses on in-app guidance rather than deep analytics. Pricing is published openly, with MAU-based tiers starting at $300/month for growing teams.

Userpilot for B2B onboarding with integrated analytics

Userpilot combines autocapture analytics, in-app guides, and resource centres without Pendo's six-month implementation timeline. It's built specifically for B2B SaaS onboarding, not adapted from consumer-focused analytics tools.

Implementation usually takes days rather than months, and pricing is transparent instead of quote-only. Plans start at $299/month, avoiding the "contact sales" friction that slows down procurement.

WalkMe for enterprise employee onboarding across complex software

WalkMe is widely used for digital adoption across internal tools like Salesforce, Workday, and SAP, particularly in organisations with thousands of employees. Its workflow automation can perform actions for users, not just show instructions, cutting training time and reducing errors.

The Discovery module flags unused software licences, often paying for itself through optimization savings that finance teams notice. WalkMe is designed for large enterprises with 200+ employees that need consistent training across multiple applications at once.

Whatfix for guided training with multi-format content generation

Whatfix delivers SCORM-compliant training packages alongside in-app guidance for enterprise rollouts and training programmes. It can automatically convert walkthroughs into videos, PDFs, and presentations for offline training and documentation.

It's stronger for employee-facing enterprise software training than for customer-facing product onboarding. Pricing is enterprise-focused and quote-based, depending on deployment size.

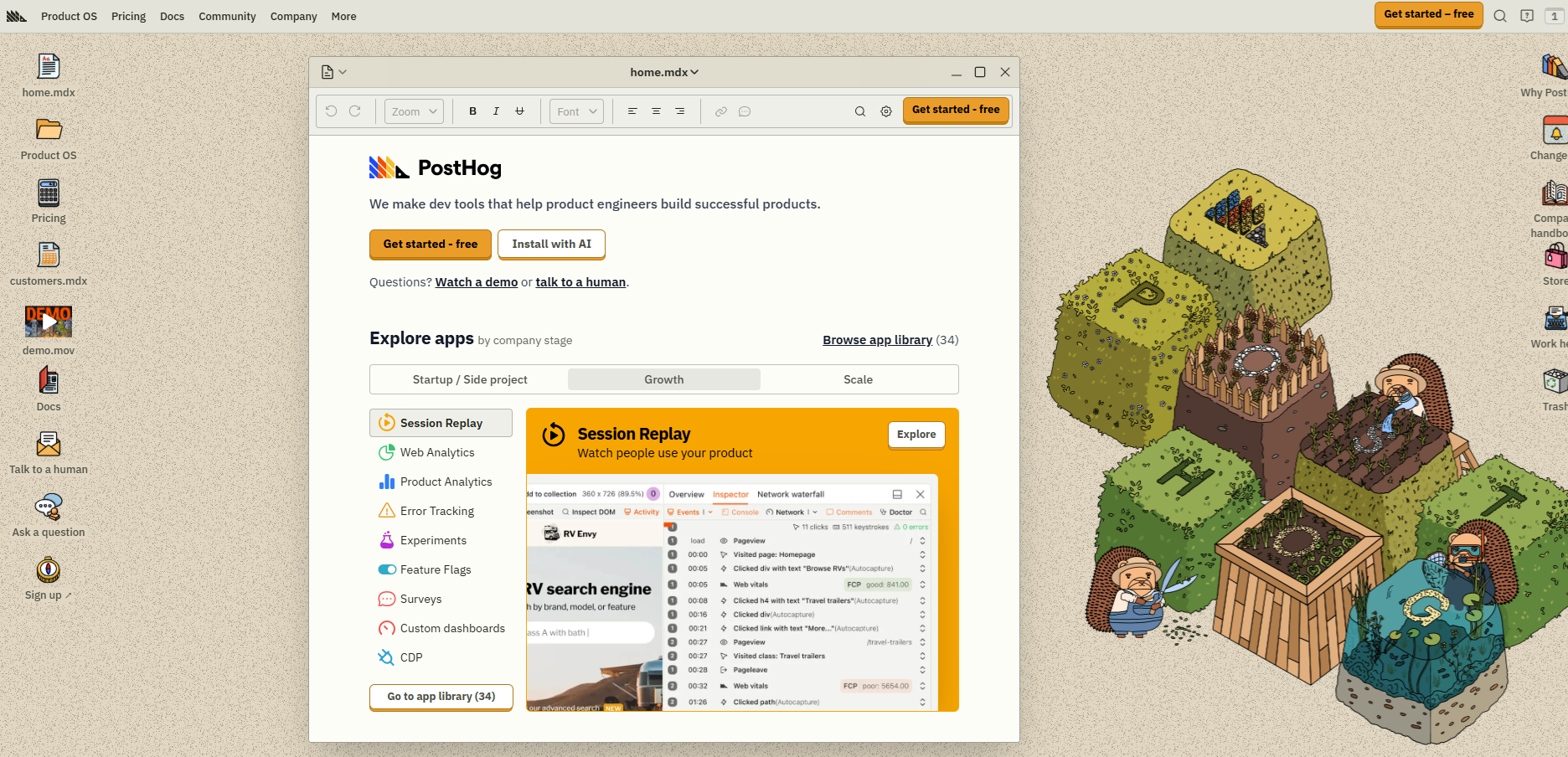

PostHog for open-source analytics without vendor lock-in

PostHog brings product analytics, session replay, feature flags, and experiments into one open-source platform you control. It's free for small teams under 1M events per month, with clear usage-based pricing once you cross that line.

It does require technical setup, including self-hosting if you choose that route. PostHog describes its core user as "Product Engineers" – developers who ship features and want to measure impact without waiting on analysts. For teams that don't want to manage servers, cloud hosting is available with the same core capabilities.

UserGuiding for essential onboarding at startup-friendly pricing

UserGuiding focuses on checklists, guides, and resource centers, priced to suit early-stage companies. Its visual editor requires no coding, so customer success teams can build and update guides without pulling developers off roadmap work.

Analytics are lighter than Pendo's, but enough to track basic feature adoption without burying small teams in data. At $2,088 per year for 2,000 MAU, it's easy to budget for seed-stage teams testing product-led growth.

Chameleon for developer-friendly guidance with built-in governance

Chameleon offers advanced targeting and alerts when guides underperform, helping prevent the guide fatigue that quietly kills adoption. Developer-friendly APIs allow technical teams to build custom integrations and automate guide launches alongside product releases.

Its governance features track engagement and automatically pause low-performing tours before users start tuning everything out. Pricing scales with MAU, with quotes provided based on volume and feature needs.

FullStory for watching sessions to diagnose friction points

FullStory pairs session replay with product analytics, letting teams watch real user sessions to pinpoint confusing workflows. Automatic capture of rage clicks, error clicks, and dead clicks highlights usability issues without manual tagging.

It offers stronger mobile support than many traditional analytics tools, including Pendo, which matters for teams with large iOS and Android audiences. Enterprise pricing is custom, typically starting above $10,000 per year for teams serious about session analysis.

Gainsight PX when product usage feeds customer success operations

Gainsight PX ties product analytics directly into enterprise customer success health scoring and automated workflows. It's part of the wider Gainsight platform, built for companies with established CS teams managing hundreds of accounts.

Implementation is complex, often involving months of health model mapping and playbook design across multiple modules. Pricing averages $30,000+ annually and targets mid-market and enterprise companies with 50+ employees and mature CS infrastructure.

If you're just collecting in-app user feedback, specialized survey tools like Qualaroo or Hotjar focus solely on feedback and NPS, without analytics depth or onboarding features.

Which path fits your team

- Analytics-first: Choose Mixpanel, Amplitude, or Heap when your product team needs to dig into retention or run experiments.

- Balanced platform: Pick Userpilot if you want analytics and in-app guidance without heavy implementation.

- Budget-conscious: Start with PostHog (free under 1M events), UserGuiding ($2,088/year), or Appcues ($300/month).

How Accoil translates analytics into signals your CS team can use

You picked an analytics tool from the list above. Maybe it's Mixpanel for flexible funnels, Amplitude for experimentation, or PostHog for an open-source setup. Then your CS team asks the same question they've asked since day one: "Which accounts should I focus on today?"

The gap between having analytics and knowing which customers need attention today

Raw events capture individual actions – logins, feature clicks, page views. CS teams, however, need account-level patterns that flag churn risk or point to expansion. That translation layer is where most teams stall, juggling spreadsheets or waiting on analysts to make sense of the data.

Accoil ingests data from Segment, RudderStack, Amplitude, and PostHog to calculate account health automatically, allowing you to skip manual spreadsheets and custom queries. Setup plugs into your existing data pipeline in hours. There's no new event instrumentation and no extra engineering project competing for backlog space.

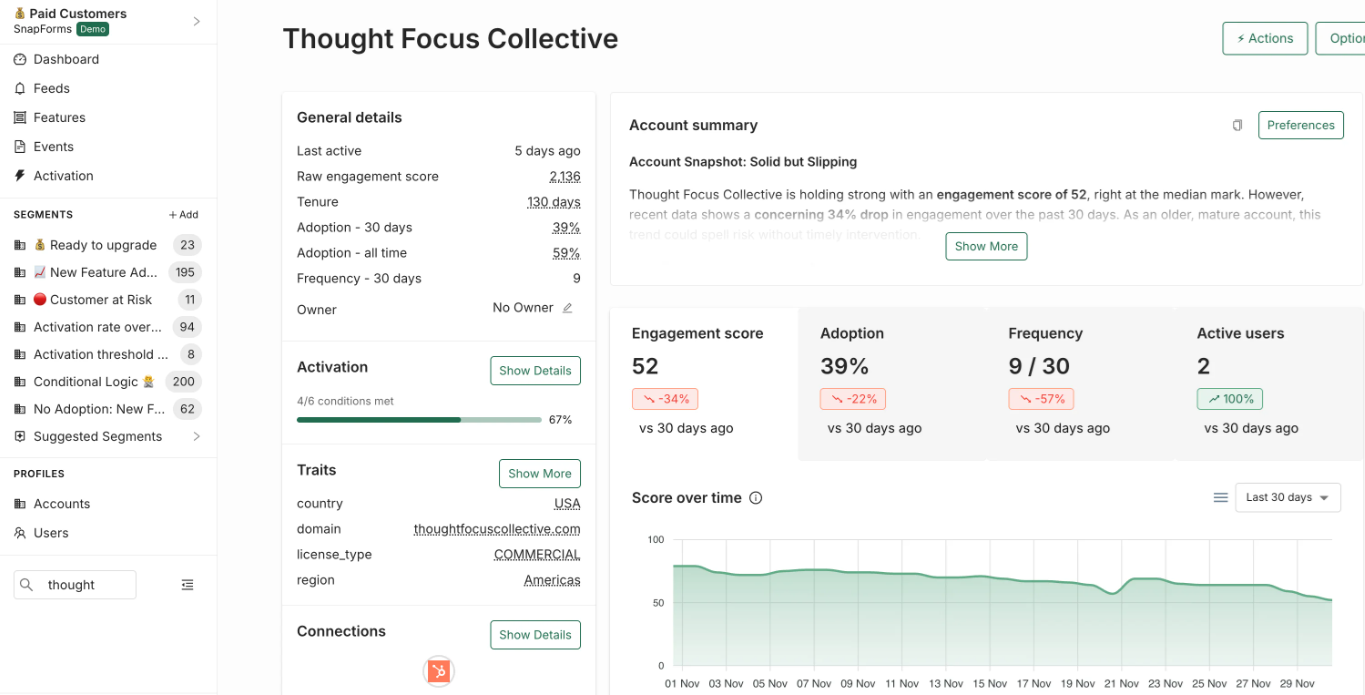

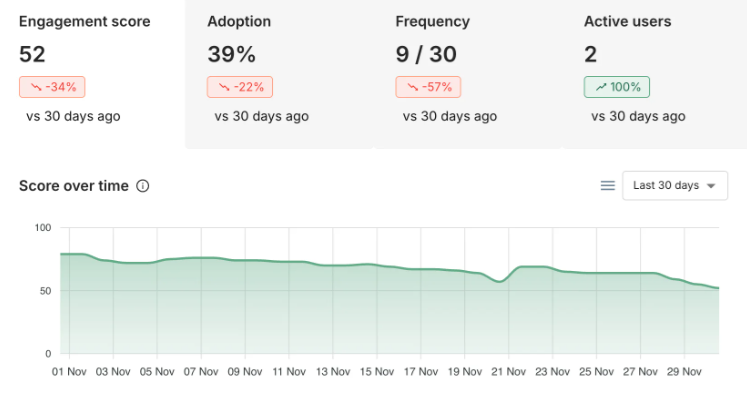

The system calculates seven metrics, including Activation Rate (onboarding completion), Frequency (usage patterns), and PQL Rate (expansion-ready accounts). Each score is explained in plain language, not buried in numbers: "Power User went inactive 5 days ago" or "Feature adoption dropped 40% this week." CS teams get clear signals they can act on, not dashboards they have to decode.

Know which accounts need attention today

Instead of combing through analytics, Accoil pushes clear health alerts straight into Slack and your CRM, so your team knows who to focus on and why.

See how Accoil delivers real-time alerts

Scores that update daily, not quarterly

Accoil generates 0–100 engagement scores by weighting feature usage against your definitions of activation and retention. New data is processed within 24 hours, so if engagement dipped yesterday, CS sees it in this morning's standup.

Alerts delivered where your team already works

Daily risk and growth feeds push account alerts straight into the Slack channels CS teams already live in. HubSpot and Salesforce integrations surface scores and suggested actions directly on account records. Custom alerts flag high-value accounts with declining engagement or Power Users going inactive during renewal windows.

The result is fewer "check another dashboard" moments. Insights land in the tools your team already uses, without extra logins, context switching, or the mental tax of deciding whether it's worth checking the data at all.

Pick your path and demo the finalists this week

You've seen three solid paths:

- Analytics-first tools like Mixpanel or Amplitude paired with health intelligence so CS teams can act without SQL.

- Balanced DAPs like Userpilot that cover onboarding and analytics without Pendo's complexity.

- Or budget-friendly options like UserGuiding and PostHog's free tier.

The two-tool approach often wins when specialization beats convenience. One login can feel tidy, but it can also lock you into average outcomes.

If your renewal deadline is coming up, book demos with your top two picks this week and push them on real scenarios. Ask how they handle your actual data. Get them to show account-level health scoring and how alerts reach your team where they already work.

Or try Accoil today and see your existing analytics turned into clear account scores your CS team can act on immediately.